Blueprints to Breakthroughs: Our Journeys in Real Estate and Resilience

Purposeful Pivots | Navigating Property Lines in a Bricks and Clicks World: Building a Career in Real Estate and Innovation | Resilience Training Through Tai Chi

Overall Synopsis:

In this edition of "Where Wellness Meets Wealth," we dive deep into the transformative journeys of overcoming and adapting—not just in our careers but in every aspect of life. Join us as we explore how strategic pivots and real estate ventures have not only shaped our financial landscapes but also reinforced our commitment to personal growth and economic empowerment. Through candid stories and insightful reflections, we uncover the potent synergy between mastering financial intricacies and navigating life's unpredictable paths.

Contents:

It Hits Different with Dr. Ali Reign →Purposeful Pivots

Snatched with Dr. Zoe Hart → Navigating Property Lines in a Bricks and Clicks World: Building a Career in Real Estate and Innovation

Smart Solutions for Self-Care: Cultivating Abundance with Science and Tech → Budgeting is More Liberation than Limitation

Life in Action: Applying Wellness Wisdom

Evidence-Based Practice 1: Mindful Budgeting & Financial Planning

Evidence-Based Practice 2: Resilience Training Through Tai Chi

Section 1: It Hits Different with Dr. Ali Reign → Purposeful Pivots

“Yesterday I was clever, so I wanted to change the world. Today I am wise, so I am changing myself." RUMI

So, picture this – you're moving through life, doing your thing, when suddenly, you’re on stuck and spinning your wheels. That's when you gotta break out your pivot moves. It's all about changing gears, remixing your mindset, and finding your inner Feng Shui.

Alright, fam, let's dive into some serious pivot action. You ever feel like you're running in sand, just treading water in the same old routine? Yeah, been there, done that. But here's the real – you got the power to flip the script and rewrite your story.

Let me talk from where I stand for sec: life's throwing body blows and head shots left and right, and you're just trying to stay on your feet until the bell rings, just so you can recover in your corner and pray you have enough for the next round. Sound familiar? That's where the real magic happens – in the pivot. It's about shifting your mindset, changing your perspective, and taking control of your own destiny.

That Rumi quote? It's like a compass for my soul, guiding me toward a new pathway, a fresh perspective. It's about realigning your life with your purpose, mapping out your goals, and finding balance in the chaos. Because let's face it – life's too short to be KO’d before the money rounds.

But here's the thing – you gotta be rooted in solid ground before you can grow to make true power moves. That's your foundation, your anchor. Once you got that locked in, you can pivot with strength, intention and confidence, like an OG.

Now, if you really wanna peep game look to martial arts – 'cause trust, I've been a student since Wu-tang and Saturday Kung-Fu theater. Whether it's Tai Chi, Krav Maga, or most recently Capoeira, the principles are the same. First rule of fight club? Avoid conflict like a bad habit. But if you gotta throw hands, don't just block hits – redirect that negative energy (sun), and embrace change like a ninja.

Bruce Lee said it best – "Be water, my friend." Adapt, flow, and roll with the punches. And remember, you don't have to go solo. Gang Gang, find your tribe, and ride the wave together. After all, the only thing you got control over is yourself – your thoughts, your actions, your vibe. So why not make it 💯?

I'm not here to drop science or preach from a pedestal. I'm just sharing my journey, one pivot at a time. From frontline emergency responses fighting Ebola, to speaking gigs in front of thousands, I've been there in rough water, felt the burnout, and come out the other side a skilled sailor.

But now? Now, it's all about giving back, sharing my cheat codes for survival in this crazy game called life. With my “partner-in-thrive” by my side, we're offering a few jewels with hopes of helping us all navigate the ups and downs like CEOs.

Cause for real for real – life's a journey, and we're all in it together. Meanwhile, I’m just walking down the hill towards my next oasis. Let's pivot, prosper, and make some magic happen. You feel me? 🥷🏾🪄🌟

“Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.”

― Bruce Lee

You’re a part of our We, and please drop a comment.

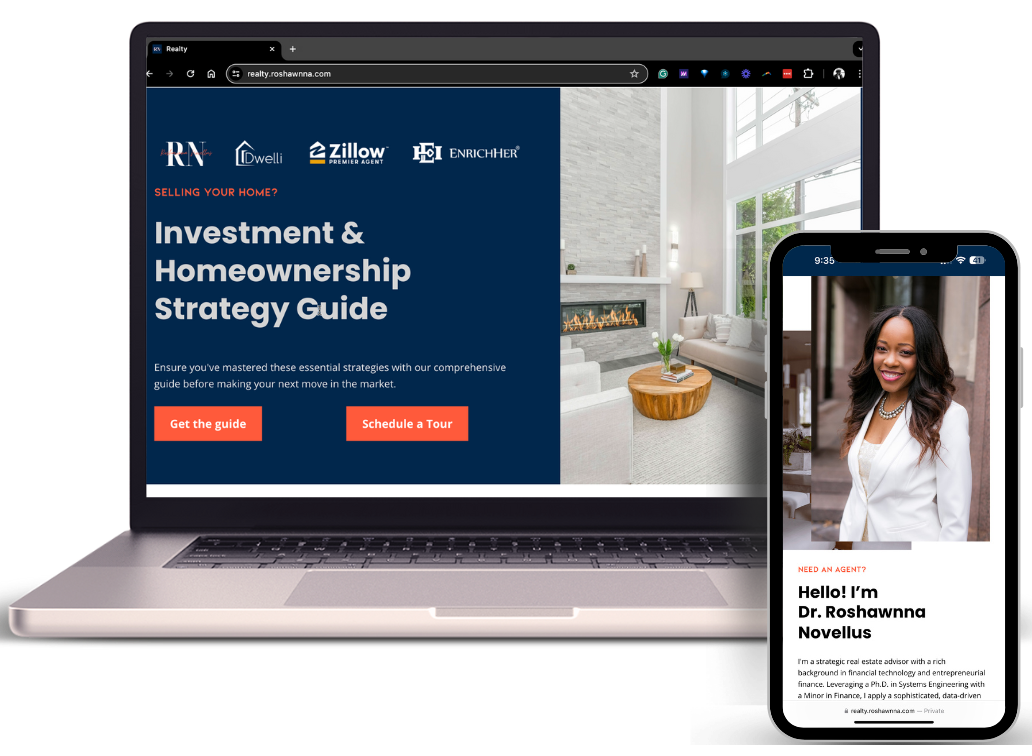

Section 2: Snatched with Dr. Zoe Hart → Navigating Property Lines in a Bricks and Clicks World: Building a Career in Real Estate and Innovation

I closed on my first house exactly a week before my "real job" started—yeah, the kind with 401(k) matching, and college tuition reimbursement—at Johns Hopkins University Applied Physics Lab (JHUAPL). Talk about a crash course in adulting! At 23, while living in Westchester County, NY, with zero clues about the DC area, all I had was guts and the example of two friends who had braved homeownership at the same age. Naturally, I thought, “If they can do it, why not me?”

I called my mom to share my ambitious plans. Predictably, she was skeptical, worried I might be biting off more than I could chew. But, as any loving mother would, she provided unwavering support (albeit with a hefty dose of maternal caution). She even put me in touch with a top-notch real estate agent in San Diego who found me a fantastic local agent in Maryland. Thanks to my signing bonus, which conveniently covered the down payment, I managed to buy a house, move to a new city, and start a new job all in one incredibly hectic week.

While working at JHUAPL, I often found myself unofficially advising colleagues on real estate and finances during closings. This role was unexpectedly fulfilling—far more engaging than my day job—and it sparked my interest in finance, prompting me to help people manage their 401(k)s, prepare tax returns, and navigate market trends.

After seven enriching years in the DMV area and completing my Ph.D. in Computer Engineering and Finance, I was ready for a new challenge. I moved to Atlanta to dive into entrepreneurship full-time. With the foresight to secure a mortgage while still employed, I embarked on a fast-paced house-hunting trip in Midtown. After reviewing several condos, my realtor introduced me to 1010 Midtown, where I immediately felt at home—a sense of déjà vu confirmed I was exactly where I needed to be. There, I met Jim Fountain, the seller's agent, whose genuine warmth and professionalism made a lasting impression on me.

This move was pivotal. I spent the next twelve years living in 1010 Midtown, where I launched my tax and accounting firm and became an Enrolled Agent, empowering clients to overcome their financial hurdles. Many were surprised to learn that owing tax debt didn't preclude them from buying a home if they were on an IRS-approved payment plan. Helping people transition from a state of financial fear to empowerment was incredibly rewarding.

After conquering the world of taxes and finance, I ventured into investment advisory (Series 7 and 63, check). But pushing mutual funds and annuities felt too... salesy. That’s when EnrichHER came into play, a fintech dream I built from the ground up to give underserved business owners a financial leg-up. Despite its success, the cruel mistress of inflation made the lending model unsustainable, and I wasn’t about to dip my toes into predatory waters. So, with a heavy heart (and a perfect AI-driven track record), I sunset the company.

My passion is to help people achieve the economic power they desire, and often, real estate serves as the perfect leverage—whether it's investing, safeguarding family, or building generational wealth. Today, meshing my love for helping people gain economic power with real estate is a natural evolution. I believe in the power of dreams and manifesting them into reality, and through real estate, I'm dedicated to helping people do just that. I joined Dwelli, the same brokerage as Jim, to help others dream, manifest, and obtain the economic power they deserve.

Life is full of pivots, twists, and turns, and my journey has been no exception. From tackling different roles in finance to exploring the realms of real estate, each venture has been a chapter in a larger story focused consistently on financial health and wellness. This thematic throughline underscores the importance of adaptability and openness to new opportunities. As the saying goes,

When I dare to be powerful — to use my strength in the service of my vision, then it becomes less and less important whether I am afraid. —Audre Lorde, Writer, Feminist, Womanist, Librarian, and Civil Rights Activist

Section 3: Smart Solutions for Self-Care: Cultivating Abundance with Science and Tech→ Budgeting is More Liberation than Limitation

Dr. Roshawnna Novellus co-authored “Budgeting is More Liberation than Limitation” with her brother Roosevelt Scales. Our smart solutions for self-care this week focus on shifting your perception of the choices that you get to make, including financial ones. We hope you enjoy the excerpt below. For more, check out the book on Amazon.

Book Excerpt

From Chapter 4 – Shifting your Perception

Managing Money Requires Resourcefulness

The greatest commodity in our current economy is resourcefulness. By definition, a commodity is marketable and able to satisfy a need or want. You use your income resources to satisfy the elements listed in your Needs vs. Wants exercise.

In addition to external resourcefulness, there is also internal resourcefulness. With internal resources you may be able to look inward to decide if you really need everything on your Needs vs. Wants sheet. Decreasing the need for outside goods and services, or increasing your internal resourcefulness, are great strategies to satisfy your needs and wants.

In business, the “do more with less” philosophy is commonplace. Unfortunately, in personal finance, many people are misguided about how to make resourceful decisions. In contrast to the business sector, individuals effectively operate with a “do less with less” mentality.

For example, with the goal of saving time (yet at the expense of higher cost), you might frequent fast food and dine-in restaurants instead of the grocery stores. By doing this you probably end up spending more money, having less quality time with your loved ones, and sacrificing your health. In fact, you might not realize that convenience comes with a premium price.

Relatively small changes in your resourcefulness can return large improvements to your results. For instance, cooking two meals a week while also eating the leftovers for lunch can save money. Learning how to cook, manage personal/familial grooming, change engine oil, or properly plan goes a long way towards reaching your financial goals.

But for resourcefulness to have the most benefit, you have to back it up with consistent action.

Section 4: Life in Action→ Applying Wellness Wisdom

Practice 1: Mindful Budgeting & Financial Planning

Description:

Mindful financial planning involves integrating mindfulness techniques into your financial decisions to promote a sense of peace and intentionality in managing money. This approach helps in reducing financial stress by encouraging a more thoughtful and focused engagement with financial matters.

Evidence Base:

Research has shown that mindfulness can significantly reduce stress and anxiety, which are often heightened when dealing with financial issues. A study published in the Journal of Financial Therapy suggests that individuals who practice mindfulness are more likely to exhibit financial health, partly due to increased emotional regulation and decreased impulsive behaviors.

Implementation:

Set Regular Check-ins: Dedicate time each week to review your financial status and upcoming expenses mindfully.

Focus on Goals: During these check-ins, focus deeply on your long-term financial goals, aligning daily financial decisions with these objectives.

Mindful Spending: Before making a purchase, take a moment to reflect on its necessity and alignment with your financial goals.

References:

"Mindfulness and Financial Well-being," Journal of Financial Therapy.

Novellus, R. (2015). Budgeting is More Liberation than Limitation. Link to purchase.

Practice 2: Resilience Training Through Tai Chi

Description:

Tai Chi, a form of gentle martial arts, is recognized for its slow and deliberate movements that emphasize flow and concentration. Incorporating Tai Chi into your routine can significantly improve your ability to handle stress and develop resilience, by harmonizing body and mind.

Evidence Base:

Research shows that Tai Chi not only helps reduce stress but also improves physical balance, flexibility, and cardiovascular health. A study published in The Journal of Psychosomatic Research indicates that regular Tai Chi practice leads to improvements in psychological well-being, including reduced stress, anxiety, and depression. The practice’s focus on deep breathing and mindful movements makes it a powerful tool for enhancing overall mental resilience.

Implementation:

Regular Practice: Start with short Tai Chi sessions, about 10-15 minutes each day, and gradually increase the duration as you become more comfortable with the movements.

Join Classes: Participate in Tai Chi classes offered at local community centers, gyms, or through online platforms to ensure proper technique and gain the most benefit.

Daily Integration: Integrate Tai Chi principles into daily life by practicing mindfulness and controlled breathing during routine activities, enhancing your calm and centeredness throughout the day.

References:

"The Effect of Tai Chi on Psychological Well-being: a Systematic Review of Randomized Controlled Trials," Journal of Psychosomatic Research

About the Authors

Who are We (Zoe & Ali)?

In "Who are We (Zoe & Ali)?", we explore the origin stories of Zoe Hart and Ali Reign and how they came together to form We (Zoe & Ali). These personas illustrate the transformative power of authentic self-expression against the backdrop of professional ambition and societal norms. Zoe, created by Dr. Roshawnna Novellus, symbolizes the journey of meldin…